If you purchased your home in the Winston-Salem area between five and nine years ago, you made one of the best financial decisions of your life, perhaps without even realizing it. The real estate landscape in the mid-2010s was a whole different ball game compared to what we see today. Back then, you likely bought your property as a “starter home,” a stepping stone to get into the market and stop paying rent.

Fast forward to now and that stepping stone has basically morphed into a valuable financial asset. Most media outlets are focused on interest rates, but what they’re not talking about is the staggering amount of equity that current homeowners are sitting on. Home prices in the Triad have gone through the roof, and you’ve managed to knock off a pretty good chunk of the mortgage. This combination puts you in a powerful position.

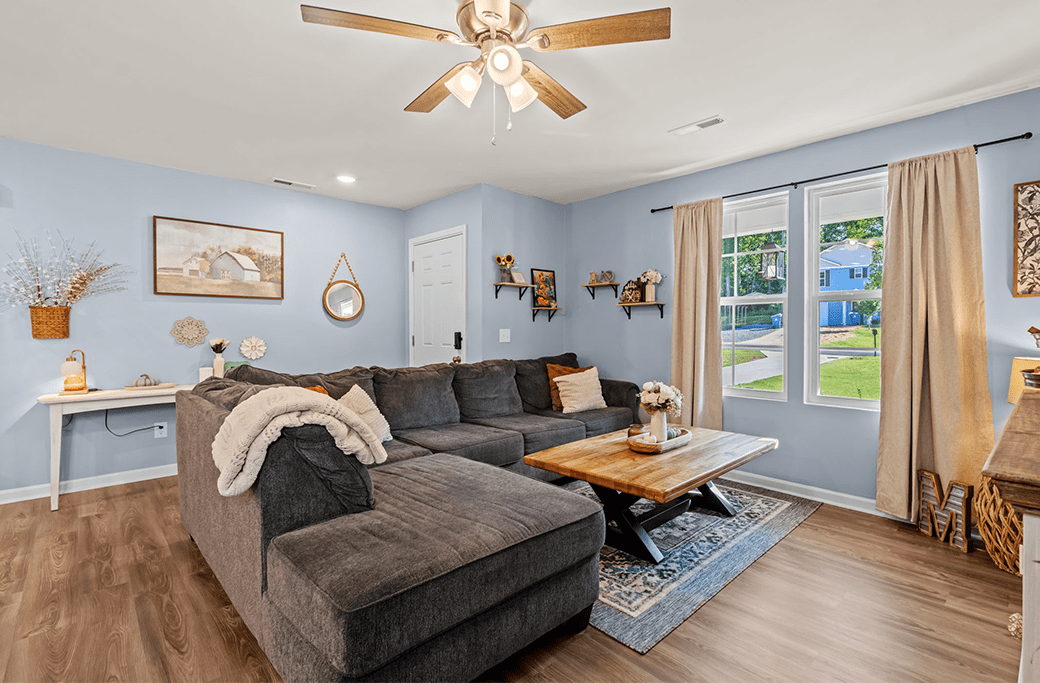

Many homeowners feel stuck, assuming that moving up is impossible in the current market. The reality is actually the complete opposite. Your built up equity is the key to unlocking a new home that better fits your lifestyle; whether that means more bedrooms, a dedicated home office, or a better school district. Here is why your home is worth more than ever and how you can leverage that value to upgrade.

Winston-Salem’s Real Estate Boom

The Winston-Salem market has seen steady growth over the last decade. This isn’t just a temporary bubble; it is the result of sustained demand coupled with the Triad area’s economic growth that’s driving the market forward.

Great Demand for Entry-Level Homes

Your current home is probably the most in-demand commodity out there. Many first-time homebuyers are entering the market, but they’re facing a serious shortage of move-in ready, affordable homes. Builders have been so focused on building the nicer, higher-end homes for years now that the supply of “starter homes” is pretty much non-existent.

When you put a well-maintained entry-level home on the market these days, you’re not just looking for some buyer, you’re often looking at multiple offers coming in. That level of competition drives prices up, and means you’re likely to get the maximum return on your initial investment.

Relocation and Regional Growth

Winston-Salem’s no longer a hidden gem. The secret’s out, for better or worse! We’re seeing a constant flow of buyers moving in from higher-cost markets who see our local prices as a steal. That external demand is putting upward pressure on home values right across the board. Plus, the expansion of local amenities from new restaurants and shops to greenway developments has revitalized neighborhoods, adding real value to homes that used to be considered on the outskirts.

What This Means for You: A Strong Equity Position

If you’ve owned your home for about 9 years now, then you’re in a pretty sweet spot financially. You’ve likely paid down a big chunk of that principal balance, and simultaneously the market value of your home has gone up.

What is Equity Anyway?

It’s very easy to look at a Zillow estimate and think of equity as just some abstract numbers. However, equity is an actual financial tool. When you sell, that equity converts into cash that then helps power your next move.

Leveraging the Power of a ‘Home Equity Upgrade’

Many homeowners are worried about trading that 3% interest rate for a higher one. That’s a fair concern, but your equity is the equalizer. By using the big proceeds from the sale of your starter home, you can then make a much bigger down payment on your next property.

Here’s what this does:

-

- Reduces the amount you borrow: You’re borrowing less, which means the higher interest rates don’t have as big impact.

- Lowers your monthly payment: A smaller loan balance keeps your monthly obligation manageable.

- Eliminates PMI: A down payment (over 20%) removes Private Mortgage Insurance, saving you hundreds of dollars a month.

Making a Move-Up Purchase Using Your Equity

Sherwood Forest

Trading up requires some strategy, though. It’s not just about selling for a high price; it’s about buying smart.

Trading Up Without the Payment Shock

Let’s do a real-world example. Suppose you bought your starter home for $150,000 back in 2016. Today, that home might sell for $250,000. After paying off your remaining mortgage and closing costs, you’d be left with anywhere from $100,000 to $120,000 in clear equity.

If you then put that $120,000 toward a $400,000 move-up home, you’re only financing $280,000. Despite higher interest rates, your mortgage payment remains comparable to what you might expect on a much smaller loan with a lower down payment. You get the home you want without feeling financially stretched to the limit.

Upgrade to a Home That Fits Your Life Today

Life has changed a lot in the last 9 years, right? Maybe your family’s grown or you’ve permanently transitioned to remote work. A move-up home offers solutions to all these lifestyle changes:

-

- Dedicated Space: No more making Zoom calls at the kitchen table.

- Outdoor Living: Larger lots for kids, pets, or entertaining.

- Better Locations: Moving closer to preferred schools (like in the Sherwood Forest or Buena Vista areas) or shorter commutes.

Bridging the Gap

I mean let’s face it, trying to buy and sell at the same time can be a real challenge. However, with the right financial tools like a bridge loan, a HELOC, or a “Buy-Before-You-Sell” program, can take a lot of the stress out of the process. With one of these options you can secure your new home before your old one closes, so you don’t have to deal with a double move.

Finding Your Next Home in Winston-Salem

Greenbrier Farm

Once you’ve decided to put your equity to work. Where do you go from here? Winston-Salem has a lot to offer for the next stage of your life.

Popular Established Neighborhoods

Neighborhoods like Ardmore have a certain charm to them, and the fact that you can walk just about anywhere is a bonus. Then there’s Sherwood Forest and Greenbrier Farm; places where families love to set up shop because of the big lots, community amenities, and the all-around suburban vibe. Starter homes can’t compete with what these neighborhoods have to offer.

New Construction Opportunities

Right now, builders are offering incentives to move inventory, including rate buy-downs and closing cost assistance. Upgrading to a new construction home means you get the modern, open layouts and the peace of mind that comes with builder warranties.

How The Ginther Group Makes the Upgrade Easier

At The Ginther Group, we’re here to help homeowners make the transition from a starter home to the home of their dreams. We get that you’re not just selling a house, you’re navigating a complicated financial and logistical situation.

Free, No-Pressure Home Value Consultation

We know online calculators can be off the mark. Our goal is to give you an honest, accurate idea of what your home is worth so you know exactly how much equity you have to play with. We’ll break down the numbers so you can budget for your next purchase with confidence.

Let’s Talk Strategy to Maximize Your Equity

We’ll work with you to figure out the best time to sell so you can get the most bang for your buck. If there’s one thing we’ve learned over the years, it’s that little touches like paint or staging can make a huge difference in how much your home’s worth.

We’ll Take Care of the Details

Our team manages the timelines so you don’t have to juggle a hundred different things at once. From marketing your current home to get multiple offers to negotiating the best terms on your new purchase, we’re the ones who’ll handle the heavy lifting. Our hope is to keep as much of your hard-earned equity as possible and get you into a home that you truly love.

Why Your Winston-Salem Starter Home Is Worth More Today

You’ve already done the hard part. You’ve bought a home, taken care of it, and paid down the mortgage. Now the market is saying thank you by giving you that equity back. Don’t let fear of the market keep you stuck in a house that’s just not working for you anymore. Your starter home has earned its place. Now let it pay off in the long run.

Want to know how much equity you’ve actually built up? Let The Ginther Group run the numbers and give you a personalized home valuation today.